How long will the semiconductor crisis last? Here’s how the chip shortage will play out according to J.P. Morgan Research.

Despite a successful vaccination rollout, the effects of the COVID-19 pandemic are still being felt across various industries, especially those reliant on semiconductors. Supply chain issues are widespread and prevalent, with the current chip shortage holding up production and denting sales. Semiconductors or chips are a crucial element in the manufacturing of consumer electronics such as smartphones, cameras and computers. In cars, they are needed for everything from entertainment systems to power steering. For the auto industry, the supply crunch and shortage of chips has forced car manufacturers to cut production and delivery targets and has led to a number of profit warnings.

In this supply chain spotlight, J.P. Morgan Research explores how the current chip shortage is impacting automakers, the “perfect storm” that is causing it and what the path forward might look like for the auto and auto parts industries.

Why Is There a Chip Shortage?

In the simplest terms, the current chip shortage is due to strong demand and no supply. This stems from COVID-19 lockdowns in the second quarter (Q2) of 2020, when demand for work-from-home technology increased exponentially. As demand grew, automakers found themselves competing for the semiconductor capacity located in Asian foundries.

Initially, car companies cancelled orders, but as production ramped up again towards the end of 2020, there was no semiconductor supply available. This was compounded by demand increases at the higher end of the autos market, as with low interest rates, affordability improved. Newer cars with more automation use more chips, further increasing the shortage.

The COVID-19 pandemic has been the catalyst, but structural factors are also part of the picture. The auto industry is changing, with a major shift towards automation and electric vehicles. These require yet more chips, causing further strain on an already stretched industry.

Globally the situation in Q3 this year has been affected by delays at key suppliers, such as Japanese semiconductor manufacturer Renesas. However, manufacturing capacity has now been restored. Adding to the problem, downstream operations in South Asia have been adversely impacted by the Delta variant in recent months, creating further bottlenecks in the supply chain.

Malaysia performs many “back-end” operations such as chip packaging and testing, which is more labor intensive than wafer fabrication processes, so activity is more easily affected by public health measures. It now seems likely that for the second half of 2021, the impact could be in the range of 3.6 and 2.6 million (m) units respectively, bringing the full year disruption to more than 10m units.

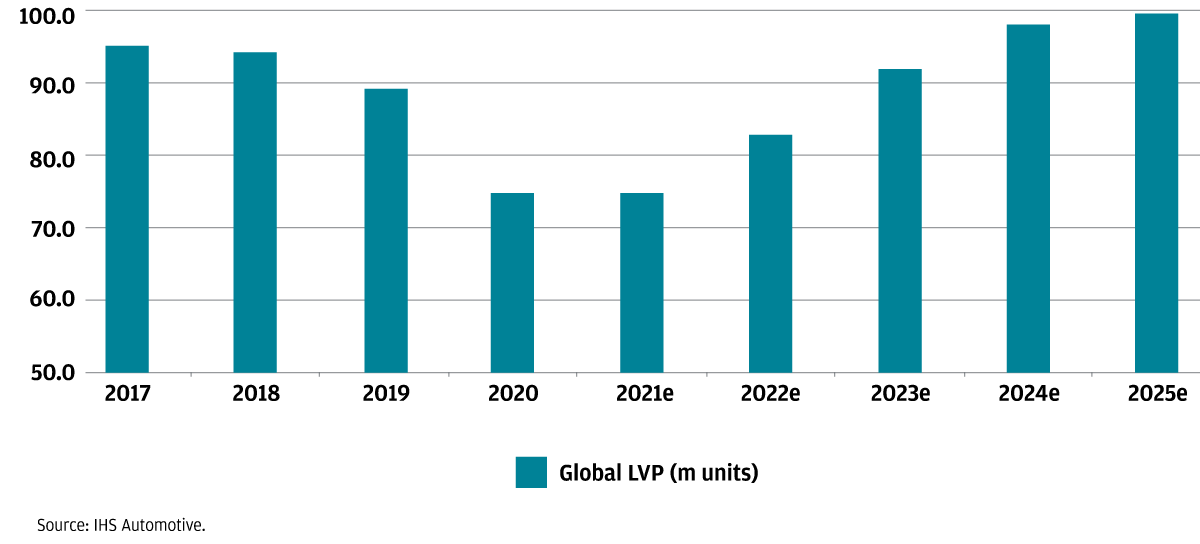

Global auto production market expectations prior to the COVID-19 pandemic

Why Is There a Chip Shortage?

Carmakers across the industry are grappling with toned down sales expectations and production cuts. Volkswagen (VW), Europe’s largest automaker said it had made around 800,000 fewer cars in Q3 of 2021, or about 35% less than in the same quarter in 2020, blaming the semiconductor supply bottlenecks.

BMW expects chip supply to remain tight for another 6-12 months, with supply chain constraints lasting well into 2022. Toyota Motor announced a 40% cut in car and truck production around the world in October, due to complications from a shortage of computer chips and COVID-19 restrictions affecting the production of parts in Southeast Asia. Honda has also said its production lines in Japan are operating at about 40% of its initial plan for the August-September period and in October, the group was running 30% below previous plans.

But the long-term outlook is still positive for the sector, according to Jose Asumendi, Head of European Automotive Research at J.P. Morgan. German carmaker Daimler sent the first signals of recovery, with the Mercedes-Benz division expecting to stabilize sales towards the end of 2021.

“The European automotive sector has in our view clearly priced in the global semiconductor production uncertainty. With Daimler giving the first positive signs of a recovery in Q4, we are talking about when to buy the autos sector, not if. The auto industry still has healthy order backlogs, the strongest OEM pricing power seen in many years and low inventory levels and dealers struggling to fulfil customer orders,” said Asumendi.

When Will the Chip Shortage End?

Carmakers across the industry are grappling with toned down sales expectations and production cuts. Volkswagen (VW), Europe’s largest automaker said it had made around 800,000 fewer cars in Q3 of 2021, or about 35% less than in the same quarter in 2020, blaming the semiconductor supply bottlenecks.

BMW expects chip supply to remain tight for another 6-12 months, with supply chain constraints lasting well into 2022. Toyota Motor announced a 40% cut in car and truck production around the world in October, due to complications from a shortage of computer chips and COVID-19 restrictions affecting the production of parts in Southeast Asia. Honda has also said its production lines in Japan are operating at about 40% of its initial plan for the August-September period and in October, the group was running 30% below previous plans.

But the long-term outlook is still positive for the sector, according to Jose Asumendi, Head of European Automotive Research at J.P. Morgan. German carmaker Daimler sent the first signals of recovery, with the Mercedes-Benz division expecting to stabilize sales towards the end of 2021.

“The European automotive sector has in our view clearly priced in the global semiconductor production uncertainty. With Daimler giving the first positive signs of a recovery in Q4, we are talking about when to buy the autos sector, not if. The auto industry still has healthy order backlogs, the strongest OEM pricing power seen in many years and low inventory levels and dealers struggling to fulfil customer orders,” said Asumendi.

The supply situation should begin to improve in 2022. Semiconductor companies are in a unique situation, constrained by supply, not demand. Semiconductor companies covered by J.P. Morgan Research have very high book-to-bill in the end market, showing strong demand. They are significantly increasing capital expenditure (capex) to meet this demand.

As the chip industry is a cyclical sector, the current period of consistent shortages suggests there will be a period of oversupply at some point in the future. Autos also generally require older chips and capacity in this sector won’t come on stream until the end of 2022. Based on the current timing of capacity ramping, the earliest there would be broad-based oversupply of auto semiconductors would be at some point in 2023, according to J.P. Morgan estimates.

“Semiconductor capacity takes time to build, which impacts supply, production and inventories. However, we believe that while news flow is still focusing on capacity shortages, later this year, this will begin to shift and auto companies will indicate that supply is improving,” said Sandeep Deshpande, Head of European Technology Research at J.P. Morgan.

The auto industry is just one sector where the supply chain has come under strain due to chip shortages. Shockwaves are also spreading across the technology sector and even those with maximum purchasing power like Apple are feeling the effects. iPhone revenue grew below typical seasonality in Q3 this year and was 2% lower quarter-over-quarter (QOQ) compared to typical growth of +10% QOQ. Revenue growth is also expected to be below average for the last three months of 2021, with J.P. Morgan estimating +82% growth, compared to a consensus of +76%, below the typical +92% QOQ. Once again, a “perfect storm” of factors are involved in technology sector chip shortages. Supply chain bottlenecks and the COVID-19 lockdown in Vietnam are hitting production, but lower-than-normal inventory has remained the most pronounced factor in the automotive and industrial market.

“We believe that semi device companies will get access to more foundry capacity over the next 12 months. However, the shortages faced in autos and industrial end markets will not end fully until new capacity comes on-stream. In this context, the market view appears to be that the autos market has a long cycle ahead but we disagree with this view as we believe that when the PC or smartphone markets weaken, autos will get more capacity ending the shortages,” added Deshpande.

Source: https://www.jpmorgan.com/